- The One Read

- Posts

- US and EU Reach A Trade Deal

US and EU Reach A Trade Deal

New trade deals | Tesla signs deal with Samsung | Massive earnings week

Welcome Back,

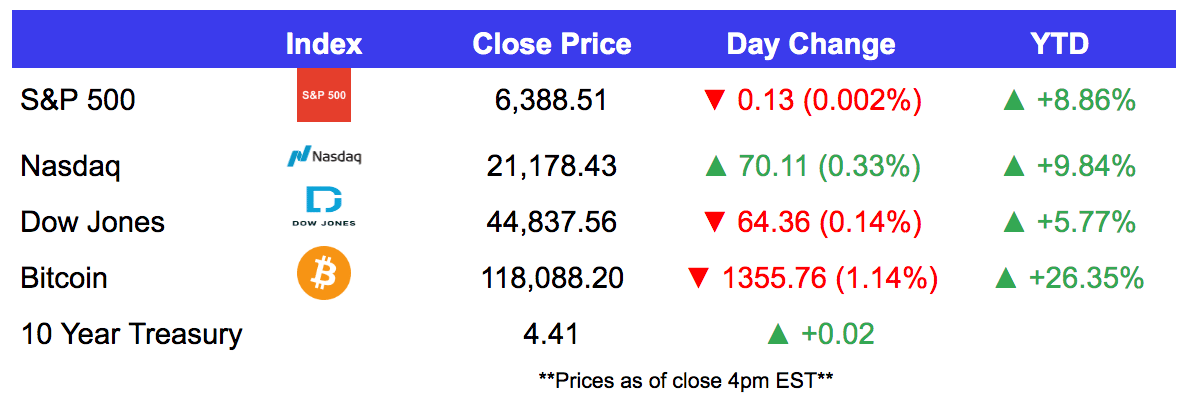

Market Headlines 👀

US and China agree to extend tariff deadline another 90 days.

US and European Union agree to a new tariff deal between the two sides.

Tesla (TSLA) has signed a $16.5b new chip deal with Samsung.

PayPal (PYPL) announces ‘Pay with crypto’, by Paypal enabling 100s of cryptocurrency options for payments.

Figma (FIG) shares will begin trading later this week, and IPO price has been raised to $30-32 as of now.

A note from Timeplast 📣

Former PepsiCo Exec Invented A Plastic That Dissolves in Water

If anyone knows a thing about plastic’s impact on the planet, it’s Manuel Rendon. The former PepsiCo executive and environmental engineer is using his 20 years of expertise to solve one of the world’s biggest problems with Timeplast.

Up to 450 million metric tons of plastic are wasted each year. Microplastics seep into our bodies, and mountains of bottles pile up in the ocean. But Timeplast has patented a water-soluble, time-programmable plastic that vanishes without harming the environment.

Major players are already partnering with Timeplast for its patented technology—their sales grew 6,000% in the first month.

You have just a few days left to invest as Timeplast scales in its $1.3T plastic market, from packaging to 3D printing. Become a Timeplast shareholder by midnight, 7/31.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

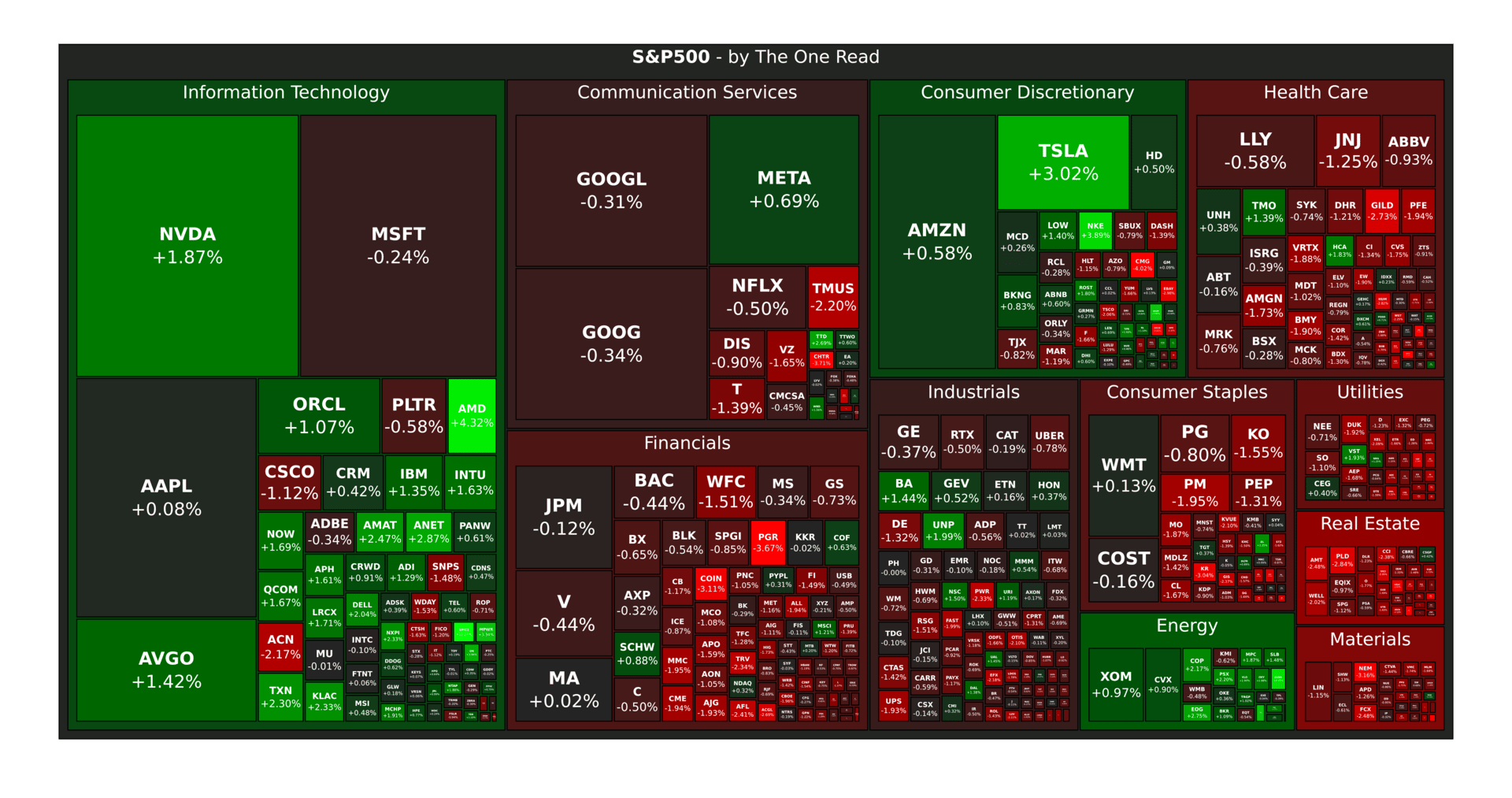

S&P 500 Heatmap 🔥

Recap Around the Street 🧠

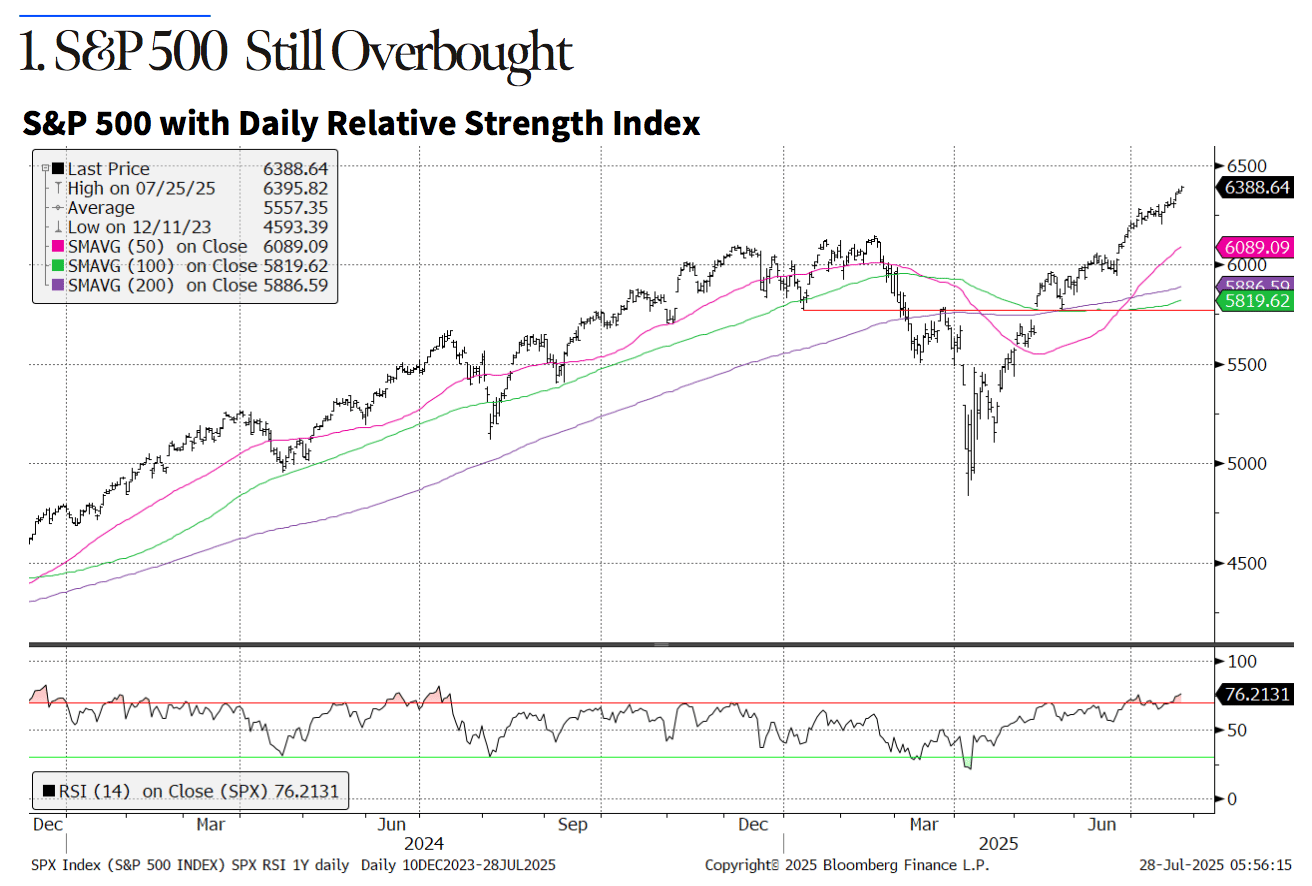

The new highs keep coming, as the S&P 500 looks to make a 6th new high in a row on Monday following the announcement of the US -EU trade deal. The S&P 500 is now trading at 22.5x forward, a higher valuation than the late 2024 peak and nearly back to the 2020 peak valuation. EPS estimates for 2025 and 2026 continue to drift slightly higher, providing a helpful backdrop for risk appetite. From a seasonal perspective, volatility tends to trend higher starting in August, as trading volumes fall, so it would not be a surprise to see some volatility reemerge through next month. Look for strong support at the March highs and the 50 day moving average (~6100). (Contributed by Cameron Dawson, CIO at NewEdge Wealth).

Source: NewEdge Wealth

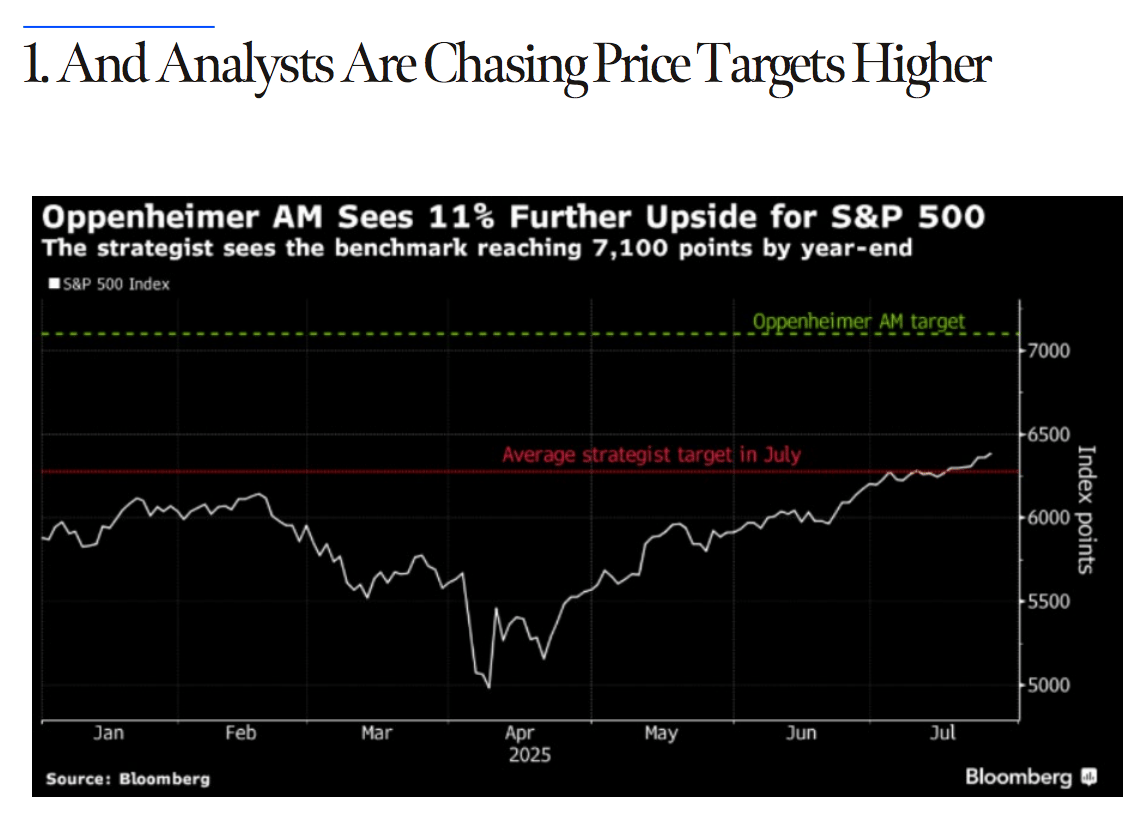

The average S&P 500 sell-side target remains slightly below today’s trading level, which suggests that we could see further target price hikes by analysts as they get on “the right side” of this rally. Oppenheimer was the latest to hike its target, now to a street high of 7100. Using their target for $275 in 2025 EPS, this implies a 25.8x valuation on the S&P 500, which would bring the index above its 2000 highs of 24.8x. It must be different this time!(Contributed by Cameron Dawson, CIO at NewEdge Wealth).

Source: NewEdge Wealth

Market Preview 🎞️

Tuesday, July 29th: Consumer confidence

Tuesday earnings: PayPal (PYPL), Sofi Financial (SOFI), United Health Group (UNH), Visa (V), Starbucks (SBUX), Spotify (SPOT), United Postal Service (UPS), Booking Holdings (BKNG) and Boeing (BA)

Wednesday, July 30th: MBA mortgage applications; US Federal Reserve Rate decision; ADP employment report; Pending home sales

Wednesday earnings: Meta Platforms (META), Microsoft (MSFT), Robinhood (HOOD), Qualcomm (QCOM), Etsy (ETSY), and Arm Holdings (ARM)

Thursday, July 31st: Weekly jobless claims; Personal consumption expenditure (PCE); Personal income and spending

Thursday earnings: Apple (AAPL), Amazon (AMZN), Coinbase (COIN), Cloudfare (NET), Reddit (RDDT), and Mastercard (MA)

Friday, August 1st: Non-farm payrolls; Unemployment rate

Friday earnings: Exxon Mobil (XOM)

Enjoy reading?👇

What did you think of today's newsletter? |

That’s all for today, folks! We’ll be back around the same time Thursday with a curated list of important news, economic data and market highlights.

🔔 Be the first to know. Ensure you never do more than one read if you:

Move our emails (especially your subscriber introduction) to your primary inbox (Quick instructions).

👋 Say hi. Responding to our emails (if any) lets your email provider know to not block us from your main inbox.