- The One Read

- Posts

- Tesla Shares Master Plan IV Details

Tesla Shares Master Plan IV Details

Tesla Master plan IV | Gold prices surge | Klarna new tech IPO incoming | Google court case update

Welcome Back,

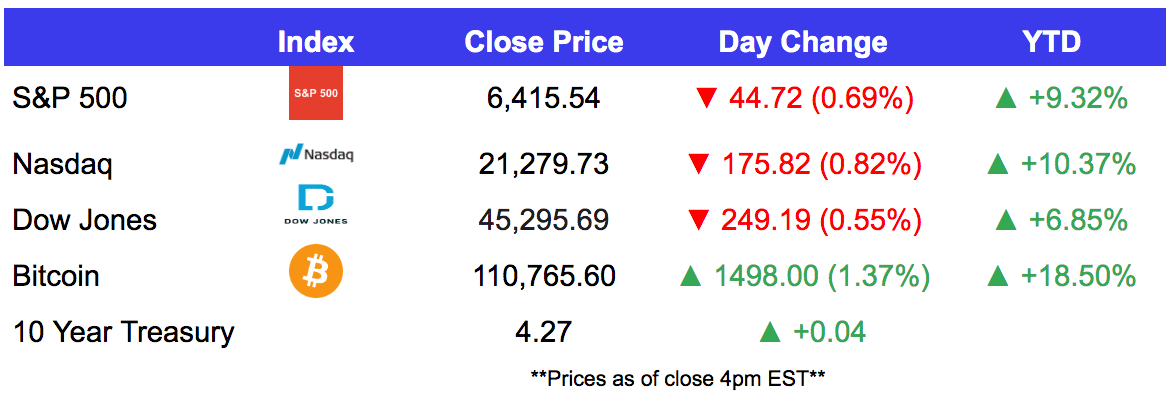

Market Headlines 👀

Tesla (TSLA) unveils its ‘Master Plan IV’.

Gold price hits the highest in 14 years as it breaches $3,600.

Alphabet (GOOGL) new ruling from judge states, company will not have to sell its google chrome business unit.

Coinbase (COIN) announces it will expand its crypto derivatives product, introducing index futures which include Mag7 names + crypto, starting Sept. 22nd.

AI startup Anthropic raises a series F round for $13b, and valuing the company at $183b.

Alibaba (BABA) shares saw a gain after a stronger then expected growth report from its cloud unit.

Alibaba (BABA) Yungeng Financial group, linked to Baba founder Jack Ma purchases 10 million $ETH.

OpenAI announces it will acquire Statsig for $1.1b in an all stock deal.

Palantir Technologies (PLTR) introduces a new AI project called ‘Working Intelligence’.

Klarna (KLAR) Sweedish buy now, pay later firm files to raise $1.3b in its IPO soon.

Nio (NIO) reported earnings, and continue to face challenges scaling its business.

Tesla (TSLA) receives 600 vehicle orders in its first month of business in India.

Earnings 💸

Zscaler (ZS)

EPS: $0.89 beats (exp. $0.80)

Revenue: $719.22m beats (exp. $707.14m)

A note from The Pacaso 📣

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Movers and Shakers 📷

📈 Top Gainers

❇️ $APA ( ▼ 2.08% ) (APA Corporation): Rose significantly after announcing positive drilling results that boosted investor sentiment.

❇️ $CYTK ( ▲ 0.54% ) (Cytokinetics): Surged on encouraging clinical trial data for one of its key pipeline drugs.

🔻 Top Decliners

🔴 $TECX ( ▼ 5.34% ) (Tectonic Therapeutic): Dropped sharply after a negative analyst report and sector weakness.

🔴 $NVDA ( ▲ 1.18% ) (NVIDIA): Breached below its 50d moving average.

🔴 $GOOGL ( ▼ 1.21% ) (Alphabet): Declined on worries about advertising slowdown and regulatory scrutiny.

🔴 $AMZN ( ▲ 1.19% ) (Amazon): Weaker-than-expected retail sales data.

this section is powered by AI

Recap Around the Street 🧠

Nvidia shares fall below its 50d moving average.

Source: Bloomberg

The S&P 500 made a new all-time high last week, but its Relative Strength Index did not. This is by no means a sign that the rally will end or the uptrend will revert (2024 is the great example of this, with a momentum divergence through nearly 6 months of new highs!). We will still file this under “Important Little Divergences” (can we make “ILD” a thing, like “fetch”?).(Contributed by Cameron Dawson, CIO at NewEdge Wealth).

Source: NewEdge Wealth

Market Preview 🎞️

Wednesday, September 3rd: MBA mortgage applications; JOLTs job openings; Factory orders

Thursday, September 4th: US weekly jobless claims; ADP employment report; ISM services data

Friday, September 5th: Non-farm payrolls; Unemployment rate

Enjoy reading?👇

What did you think of today's newsletter? |

That’s all for today, folks! We’ll be back around the same time Thursday with a curated list of important news, economic data and market highlights.

🔔 Be the first to know. Ensure you never do more than one read if you:

Move our emails (especially your subscriber introduction) to your primary inbox (Quick instructions).

👋 Say hi. Responding to our emails (if any) lets your email provider know to not block us from your main inbox.