- The One Read

- Posts

- Nvidia Aiming To Release New Computer For Robots

Nvidia Aiming To Release New Computer For Robots

EV $7,500 credit ending? | FTC comes after Microsoft, EU after Meta | PPI and Powell latest remarks

Welcome Back,

Market Headlines 👀

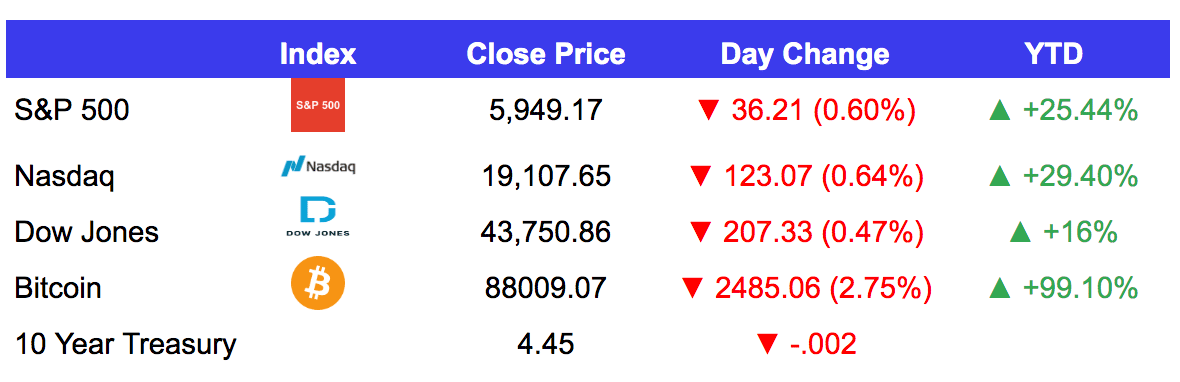

US PPI came in higher for the month of October rising 0.2% MoM. Rising to 2.4% YoY; est: 2.3%.

US weekly jobless claims come in lower than expected at 217k; est: 220k.

US Federal Reserve chair Jerome Powell says the Fed is in no hurry to cut rates and provided his thoughts on the economy in an interview.

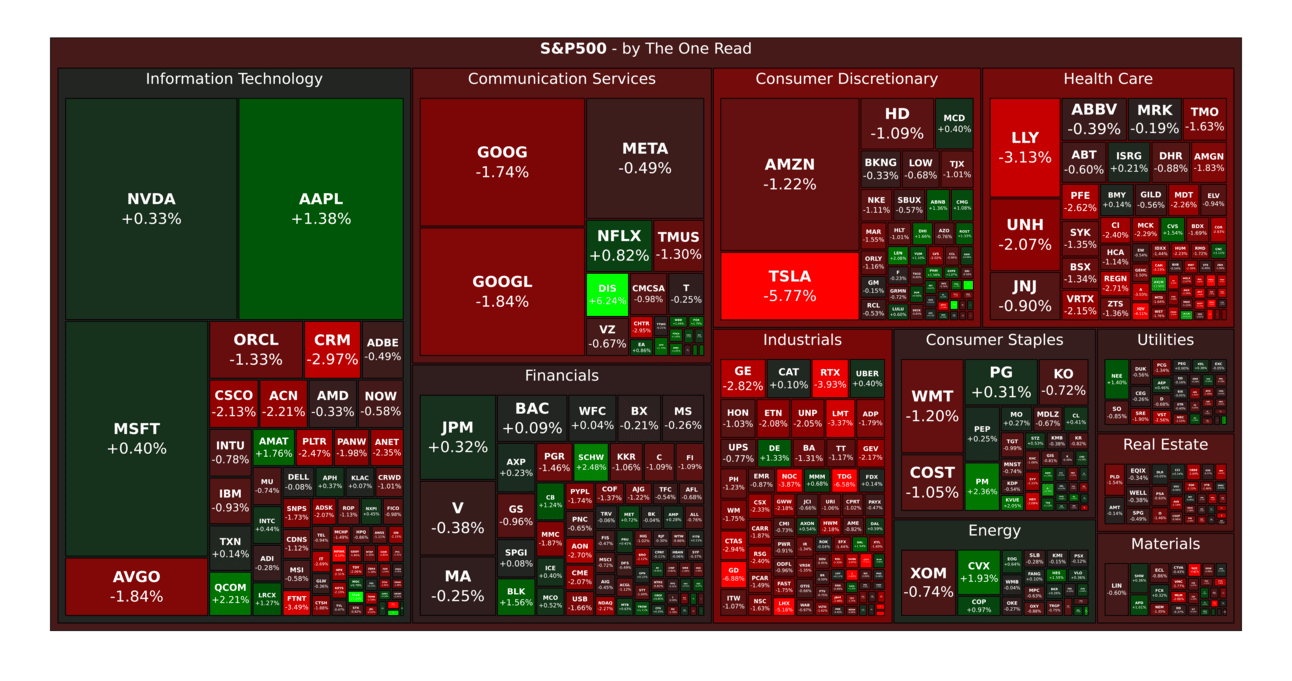

US President elect Trump aims to cut the $7,500 credit available for EVs, causing Tesla shares to fall today.

Nvidia (NVDA) plans to release its Jetson Thor computers in the 1h of 2025 designed to power humanoid robots.

Microsoft (MSFT) FTC regulators are planning an investigation into Microsoft’s cloud business.

Meta Platforms (META) EU imposes a €798m over tying their marketplace product into ads.

Meta Platforms (META) is preparing to launch ads in its Threads product in early 2025.

Robinhood (HOOD) expands cryto coins which can now be trading on the platform adding Solana, XRP and more.

Amazon (AMZN) announces new medical services and products which will directly compete with HIMS.

Amazon (AMZN) announces its low cost competitor to Temu and Shein, will be called Amazon 'Haul’ featuring products for $20 or less.

Advanced Micro Devices (AMD) announces a 4% layoff across the firm, impacting roughly 1,000 employees.

Coinbase (COIN) acquires Utopia labs an on-chain payments platform.

China bond sales being issued in USD for the first time since 2021 sees a strong demand for some durations seeing 20x the bid size.

Earnings 💸

Walt Disney (DIS)

EPS: $1.14 beats (exp. $1.10)

Revenue: $22.6b beats (exp. 22.4b)

Jd.com (JD)

EPS: ¥4.68 misses (exp. ¥7.43)

Revenue: ¥260.39b beats (exp. ¥260.36b)

A note from Masterworks 📣

Invest with the art investment platform with 23 profitable exits.

How has the art investing platform Masterworks been able to realize an individual profit for investors with each of its 23 exits to date?

Here’s an example: an exited Banksy was offered to investors at $1.039 million and internally appraised at the same value after acquisition. As Banksy’s market took off, Masterworks received an offer of $1.5 million from a private collector, resulting in 32% net annualized return for investors in the offering.

Every artwork performs differently — but with 3 illustrative sales (that were held for 1+ year), Masterworks investors realized net annualized returns of 17.6%, 17.8%, and 21.5%.

Masterworks takes care of the heavy lifting: from buying the paintings, to storing them, to selling them for you (no art experience required).

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

S&P 500 Heatmap 🔥

Recap Around the Street 🧠

$SPY - after hitting the pivotal $600 mark, which conveniently aligned with the 1.618 golden Fibonacci extension from summer’s high-to-low range, price has taken a pause this week. For the bulls, this is the ideal setup, with price correcting through time instead of simply reversing lower. The key level to hold now is last Wednesday's election surge gap, around $586, as a dip back into that gap could spell trouble ahead.(Contributed by Jason Krutzky of Trendspider )

Coinbase just staged a major breakout after a prolonged 8-month consolidation, fueled by the excitement around Trump’s election as the first crypto-friendly president. The stock's surge signals a potential paradigm shift for the entire space, as investors flock to the digital asset market. With the first weekly bullish MACD cross in nearly six months, a retest of the descending broadening pattern’s upper boundary could set the stage for an even more powerful continuation to the upside.(Contributed by Jason Krutzky of Trendspider )

$TSLA - When Elon bets, he goes all in—and his bold backing of Trump’s campaign has certainly paid dividends for Tesla, with shares surging up to 50% since the election results hit. With all-time highs now within reach, a solid retest and hold of the year-long resistance at $280 could be the green light for Tesla’s next big leap forward.(Contributed by Jason Krutzky of Trendspider )

— > TrendSpider's Black Friday SALE is live and FREE TRIALS are back for a limited time. Save up to 71% during their biggest sale of the year. ←

Market Preview 🎞️

Friday, November 15th: NY Fed manufacturing data; Retail sales data

Enjoy reading?👇

What did you think of today's newsletter? |

That’s all for this week, folks! We’ll be back around the same time Monday with a curated list of important news, economic data and market highlights.

🔔 Be the first to know. Ensure you never do more than one read if you:

Move our emails (especially your subscriber introduction) to your primary inbox (Quick instructions).

👋 Say hi. Responding to our emails (if any) lets your email provider know to not block us from your main inbox.