- The One Read

- Posts

- Google Hits All Time Highs

Google Hits All Time Highs

PPI data | Nasdaq rebalance tomorrow | Charts of the week

Welcome Back,

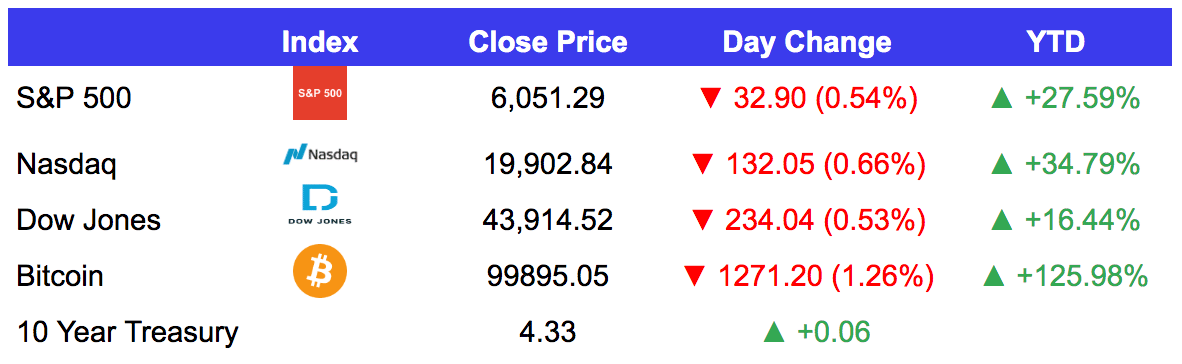

Market Headlines 👀

US Price Producer Index (PPI) came in higher than expected at 3% YoY; est: 2.6%.

US weekly jobless claims came in higher than expected at 242k; est: 221k.

European Central Bank (ECB) cuts rates to 3% from 3.25% in their third straight rate cut.

Nasdaq 100 index rebalancing will be announced later tomorrow and go into effect this month.

Adobe (ADBE) shares fell the most in over two years after the market wasn’t pleased with its 2025 forward guidance shared in their earnings.

ServiceTitan (TTAN) shares began trading through their IPO today opening at over $100 or roughly a $9b marketcap.

Earnings 💸

Adobe (ADBE)

EPS: $4.81 beats (exp. $4.67)

Revenue: $5.61b beats (exp. 5.54b)

Costco (COST)

EPS: $4.04 beats (exp. $3.79)

Revenue: $62.2b beats (exp. $62.03b)

Broadcom (AVGO)

EPS: $1.42 beats (exp. $1.39)

Revenue: $14.05 misses (exp. 14.1b)

A note from Long Angle 📣

Long Angle: Where HNW Investors Access Institutional-Grade Alternative Investments

Long Angle is a private, vetted community that connects high-net-worth entrepreneurs and executives with institutional-grade alternative investments.

Leveraging collective expertise and scale, members access top-tier opportunities across private equity, private credit, search funds, litigation finance, energy, hedge funds, secondaries, and more.

Investing hundreds of millions of dollars each year, Long Angle negotiates preferential terms and exclusive allocations.

No membership fees.

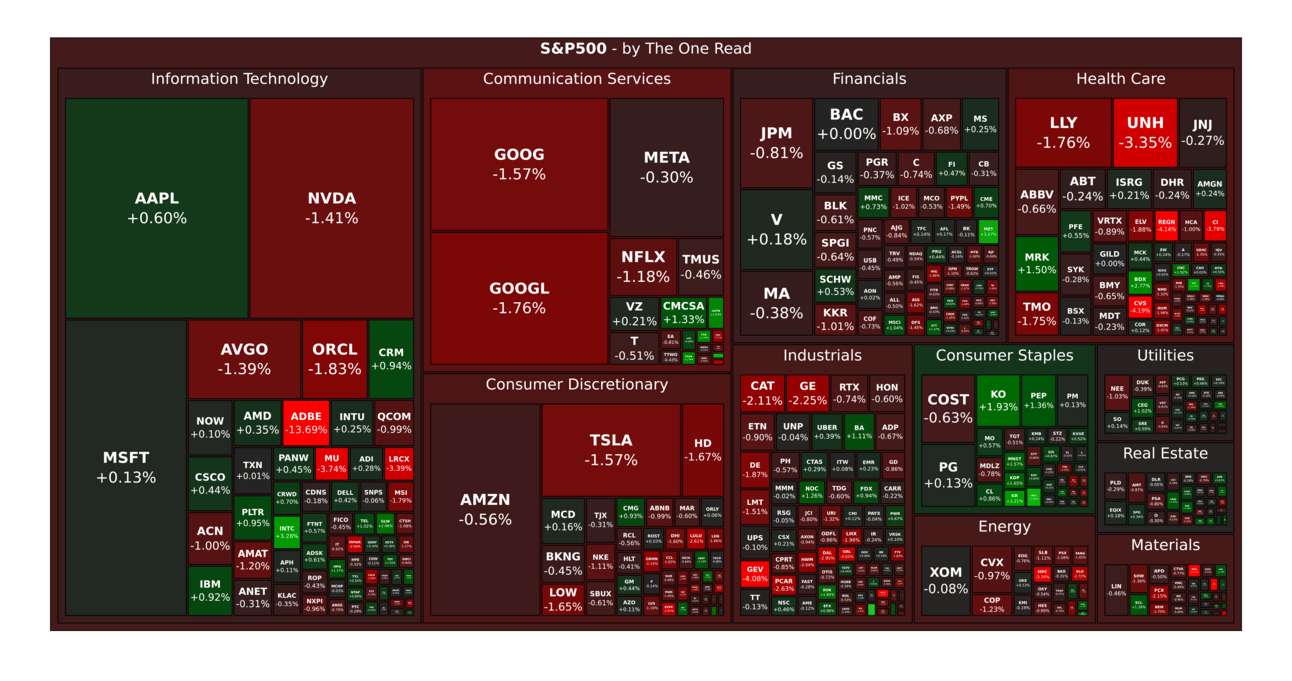

S&P 500 Heatmap 🔥

Recap Around the Street 🧠

SPY: Despite a CPI print that effectively cleared the path for a Federal Reserve rate cut next week, price action on the SPY continues to tighten into the apex of a rising wedge pattern. While tech broke out of a similar pattern last week—indicating a notable shift in leadership—bulls will need to see a strong move higher in the near term. Otherwise, Wednesday’s failed attempt at a new high could be a warning sign of further weakness ahead.(Contributed by Jason Krutzky of Trendspider )

PLTR: All eyes have been on Palantir over the past few months as the stock has absolutely ripped higher, despite a cacophony of calls declaring it overvalued. Now trading at 203x earnings, these concerns aren't unfounded, but it's worth noting that its current price-to-earnings ratio mirrors what it was when the stock traded at $7 back in February 2023—suggesting that Palantir's earnings have grown in lockstep with its price. For a name like Palantir, where expectations of rapid growth are baked into the story, such a lofty multiple might not be as unreasonable as it seems.(Contributed by Jason Krutzky of Trendspider )

META: After a month-long, textbook descending channel consolidation, META finally broke out last week, extending up to the all-important 1.618 Fibonacci extension target measured from the October high to the November low. Whether or not he watches the charts, Zuckerberg played this move like a pro, capitalizing on the stock's strength to cash out $155 million worth of shares since the breakout.(Contributed by Jason Krutzky of Trendspider )

Enjoy reading?👇

What did you think of today's newsletter? |

That’s all for this week, folks! We’ll be back around the same time Monday with a curated list of important news, economic data and market highlights.

🔔 Be the first to know. Ensure you never do more than one read if you:

Move our emails (especially your subscriber introduction) to your primary inbox (Quick instructions).

👋 Say hi. Responding to our emails (if any) lets your email provider know to not block us from your main inbox.