- The One Read

- Posts

- The Disinflation Narrative is Dead

The Disinflation Narrative is Dead

Markets spiraling downwards after Fed testimony, banks are suing, and Musk is receiving heat from new parties.

Welcome back,

Fed Chair Jerome Powell has struck again, with his news that interest rates may go even higher sending stocks falling even further.

Let’s keep it concise.

Market Headlines 👀

Meta (META) plans thousands more layoffs as soon as this week.

Stripe faces a $3.5B tax bill as employees' shares expire.

Rivian (RIVN) announces a proposed “green convertible senior notes” offering.

Japan’s inaugural launch of a next-generation rocket was aborted because the second-stage engine failed to ignite – welcome news to competitor SpaceX.

China’s new foreign minister says the US created the crisis over Taiwan.

TikTok is rolling out “Project Clover,” an offensive aimed at convincing European politicians that it’s secure.

President Biden proposes a tax hike on income over $400,000 to fund Medicare.

Bankrupt FTX affiliate Alameda sues Grayscale.

Salesforce (CRM) launched Einstein GPT, a generative AI CRM technology.

SoFi Bank (SOFI) sues to stop President Biden’s student loan repayment pause.

SoFi says it lost $200M on the freeze.

Marlboro maker Altria (MO) agrees to buy e-cigarette startup NJOY for nearly $2.8B.

EU tells Elon Musk to hire more staff to moderate Twitter (TWTR).

January consumer credit is up 3.7% to $14.8B (exp. $25.35B, prev. $10.7B).

Earnings 💸

Sea (SE)

EPS: $0.72 beats (exp. -$0.78)

Revenue: $3.5B beats (exp. $3.12B)

Dick’s (DKS)

EPS: $2.93 beats (exp. $2.88)

Revenue: $3.6B beats (exp. $3.45B)

Squarespace (SQSP)

EPS: -$1.73 misses (exp. $0.11)

Revenue: $228.8M beats (exp. $222.17M)

CrowdStrike (CRWD)

EPS: $0.47 beats (exp. $0.43)

Revenue: $637.4M misses (exp. $624.68M)

Recap Around the Street 🧠

Fed Chair Powell just opened the door to faster rate moves and a higher peak in interest rates. As Chair, Powell speaks to a Senate panel semiannually on the state of the U.S. economy. With growing fear of recession, this session was understandably tenser than usual.

In discussing recent economic releases, Powell noted that data suggests "the ultimate level of interest rates is likely to be higher than previously anticipated." So far, Powell has seen little evidence of deflation in core services (excluding housing). In his view, the “only way out” is for Congress to raise the debt ceiling.

Following Powell’s hawkish speech, US 2-year yields jumped to almost 5% while the S&P 500 and Dow each fell 1%. Fed swaps have repriced to favor a 50 bps hike in March instead of a 25 bps one.

Source: Bianco Research

Q4 earnings for S&P 500 companies disappointed across the season. For Q4 2022, 69% of S&P 500 companies reported a positive EPS (earnings per share) surprise. 65% reported a positive revenue surprise.

Though those statistics appear positive, fewer S&P 500 companies reported positive EPS surprises than average. The magnitude of earnings surprises was also smaller than average.

Q4 will mark the first time the S&P 500 has reported a year-over-year decline in earnings since Q3 2020 (-5.7%). Just 1% of companies have yet to report.

Source: Bloomberg

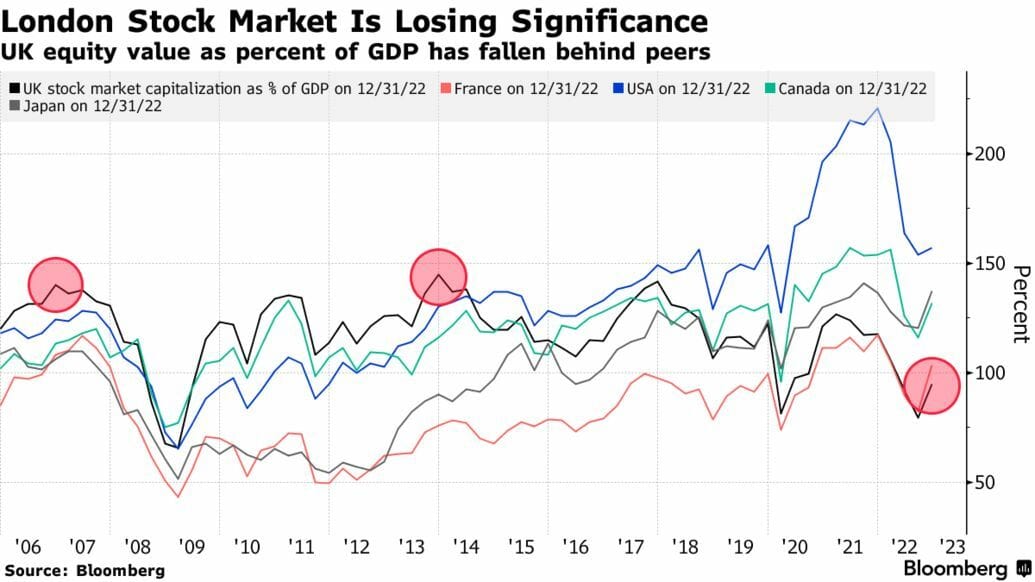

London’s investment appeal is unraveling in its post-Brexit economic environment. In the latest blow to UK tech ambitions, Softbank’s Arm (a UK chip designer) picked the US (and the US only) to IPO. The UK government and London Stock Exchange officials had hoped Arm—which was listed in both London and New York before it was bought by SoftBank in 2016 for $31B—would pursue a dual listing.

Companies view US exchanges as having deeper investor bases and often hope to trade at higher multiples. For many in the UK's tech sector, Arm's decision to forgo the UK has sparked fears about the future of London as a hub for innovative companies, especially in science.

The recent wave of firms seeking US listings is a broader hit to risk sentiment in the UK. Tight liquidity and a drop in pension fund investments have further dented its outlook.

Source: Bloomberg

Market Preview 🎞️

Wednesday: Eurozone GDP, US MBA mortgage applications, ADP employment change, trade balance, JOLTS job openings, Canada rate decision, EIA crude oil inventories

Wednesday: MongoDB (MDB) & Asana (ASAN) earnings

Thursday: US Challenger job cuts, initial jobless claims, household change in net worth, China CPI & PPI

Thursday: JD.Com (JD), BJ’s (BJ), Ulta Beauty (ULTA), DocuSign (DOCU) & Oracle (ORCL) earnings

Friday: US nonfarm payrolls, unemployment rate, monthly budget statement, Bank of Japan policy rate decision, Apple (AAPL) annual shareholder meeting

Set a reminder to tune into our next Twitter Spaces March 13th at 3PM EST. We’ll be previewing the CPI release and its macroeconomic implications, featuring a slate of speakers you won’t want to miss.

What did you think of today's newsletter? |

That’s all for today, folks! We’ll be back around the same time tomorrow with a curated list of important news, economic data and market highlights.

🔔 Be the first to know. Ensure you never do more than one read if you:

Move our emails (especially your subscriber introduction) to your primary inbox (Quick instructions).

👋 Say hi. Responding to our emails (if any) lets your email provider know to not block us from your main inbox.