- The One Read

- Posts

- Apple's Next Ultra Smartwatch

Apple's Next Ultra Smartwatch

UP CPI preview | Apple watch update | Tesla wants to enter India

Welcome Back,

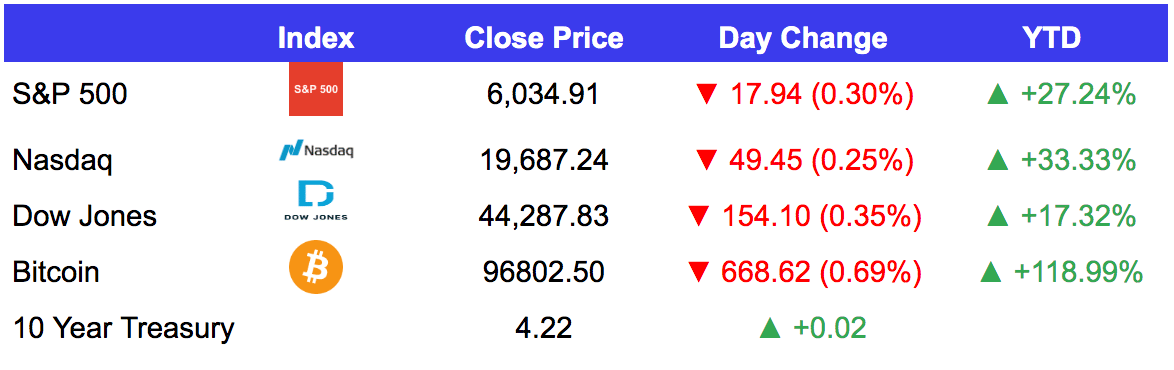

Market Headlines 👀

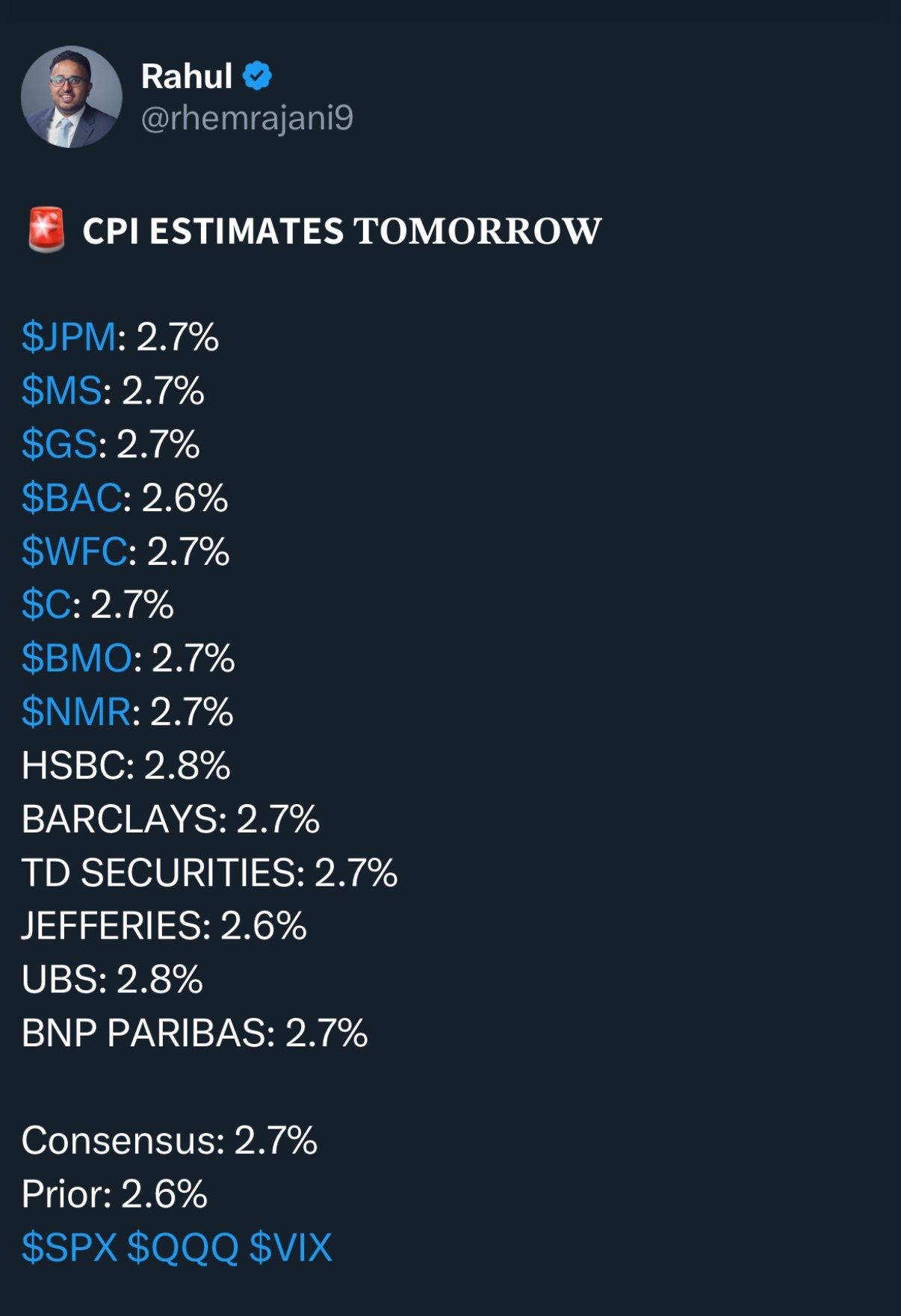

US CPI releases tomorrow morning, the street expects a 2.7% YoY number, find all estimates here.

Apple (AAPL) the next Apple ultra smartwatch could feature the ability to send texts via satellite, and they continue to ramp its work around a blood pressure feature.

Tesla (TSLA) shares rally for the 5th straight day and saw another street price target revision upwards to $400 from Morgan Stanley analyst Adam Jones.

Tesla (TSLA) has revamped plans to expand into India after multiple stalled attempts in the past.

Microsoft (MSFT) company shareholders voted against adding Bitcoin to its balance sheet.

Alphabet (GOOGL) announces its first ever Quantum computing chip - ‘Willow’.

General Motors (GM) announces the company will no longer fund its robotaxi Cruise division.

Krogers (KR) deal worth $24.6b to acquire Albertsons has been blocked by a US Federal judge.

Amazon (AMZN) will begin testing ‘15 min’ delivery on grocery items in India soon.

Earnings 💸

Gamestop (GME)

A note from Makor Coffee 📣

What we’re drinking during the bull run:

MakorCoffee.com - The world’s first anti-inflammatory coffee, blending arabica beans with superfoods like turmeric, cacao, and chaga mushroom. We found it to be the perfect balance between boomer caffeine and Gen Z nootropics. All focus. No jitters.

Use code OneRead15 for 15% off.

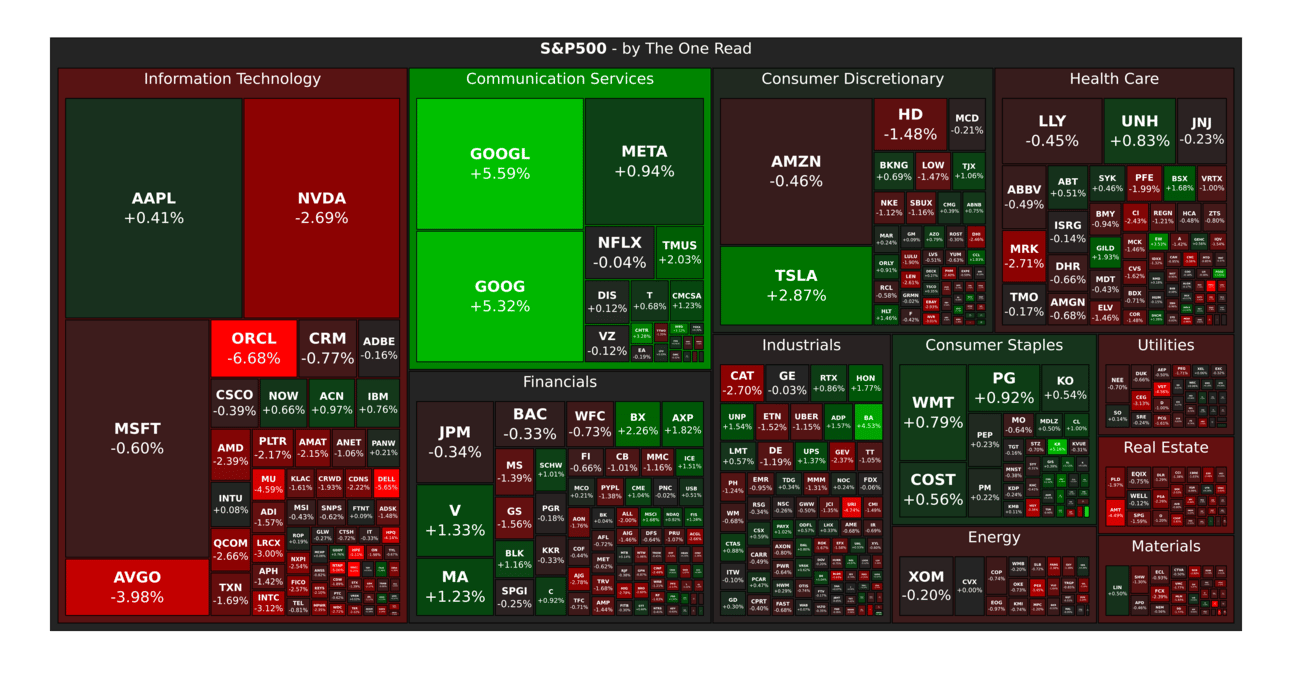

S&P 500 Heatmap 🔥

Recap Around the Street 🧠

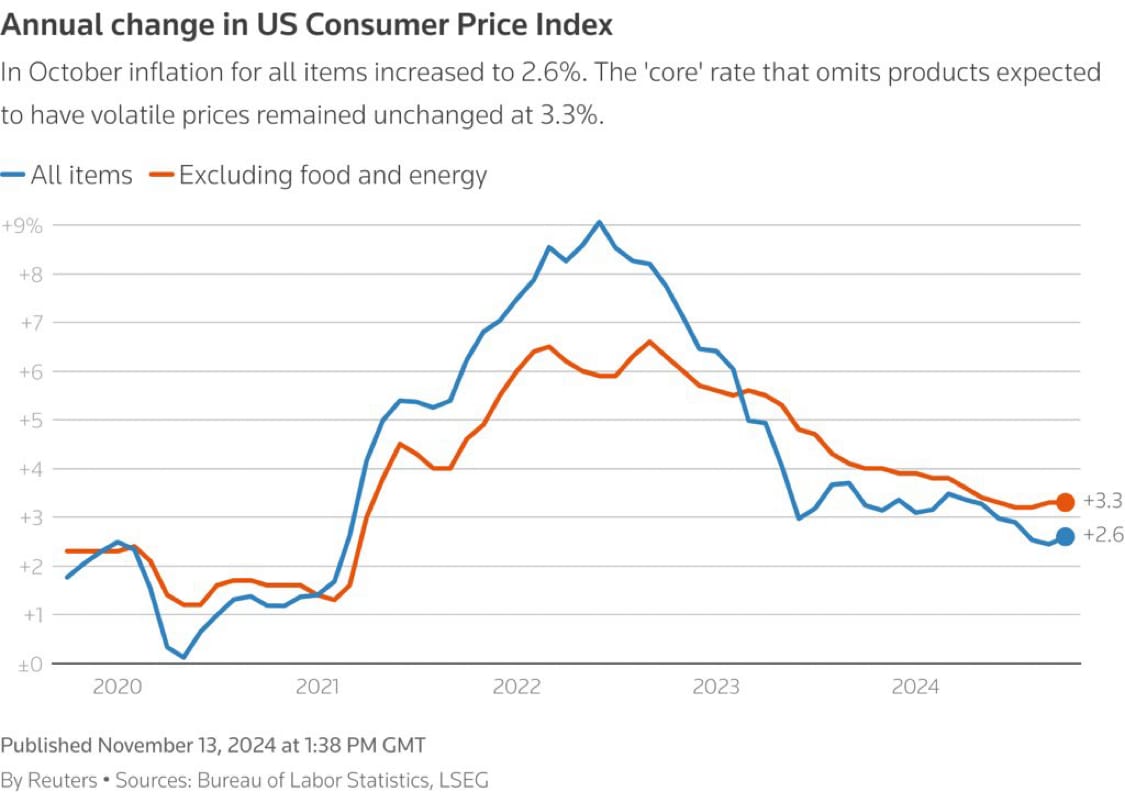

US CPI estimates from the street below. Prior month we say YoY CPI come in at 2.6%, consensus this time around is a tick above at 2.7%.

Source: Reuters

Market Preview 🎞️

Wednesday, December 11th: MBA mortgage applications; Consumer price index (CPI) data

Thursday, December 12th: Weekly jobless claims; Price producer index (PPI) data

Enjoy reading?👇

What did you think of today's newsletter? |

That’s all for today, folks! We’ll be back around the same time Thursday with a curated list of important news, economic data and market highlights.

🔔 Be the first to know. Ensure you never do more than one read if you:

Move our emails (especially your subscriber introduction) to your primary inbox (Quick instructions).

👋 Say hi. Responding to our emails (if any) lets your email provider know to not block us from your main inbox.