- The One Read

- Posts

- Apple Reports Earnings And Announces Largest Share Buyback In History

Apple Reports Earnings And Announces Largest Share Buyback In History

Earnings season | US Fed FOMC takeaways | Amazon / Anthropic news

Welcome Back,

Together with Carbon Finance:

Market Headlines 👀

US weekly jobless claims come in at 208k; est: 212k.

US JOLTS jobs data shows, job openings hit its lowest levels since 2021.

Apple (AAPL) announces its largest buyback ever of $110b and increases dividend.

Block (SQ) Jack Dorsey CEO states company will buy Bitcoin monthly with 10% of its gross profits.

Amazon (AMZN) Anthropic AI startup backed by Amazon just launched its first enterprise offering and iOS app to compete further with ChatGPT.

Microsoft (MSFT) announces they will open a new AI data center in Thailand, after recently announcing a $1.7b investment into Indonesia over the next four years.

Alphabet (GOOGL) announces layoffs for some core employees and moving those jobs to India and Mexico in order to cut costs.

Peloton (PTON) CEO announces he will step down and company plans a 15% workforce reduction.

Earnings 💸

Apple (AAPL)

EPS: $1.53 beats (exp. $1.51)

Revenue: $90.8b beats (exp. $90.6b)

Coinbase (COIN)

EPS: $4.40 beats (exp. $1.05)

Revenue: $1.6b beats (exp. $1.34b)

Cloudfare (NET)

EPS: $0.16 beats (exp. $0.13)

Revenue: $379m beats (exp. $373.3m)

Block (SQ)

EPS: $0.74 beats (exp. $0.73)

Revenue: $5.96b beats (exp. $5.82b)

Booking Holdings (BKNG)

EPS: $20.39 beats (exp. $14.09)

Revenue: $4.4b beats (exp. $4.25b)

DraftKings (DKNG)

EPS: $0.03 beats (exp. $-0.20)

Revenue: $1.18b beats (exp. $1.12b)

Newsletter recommendation 📣

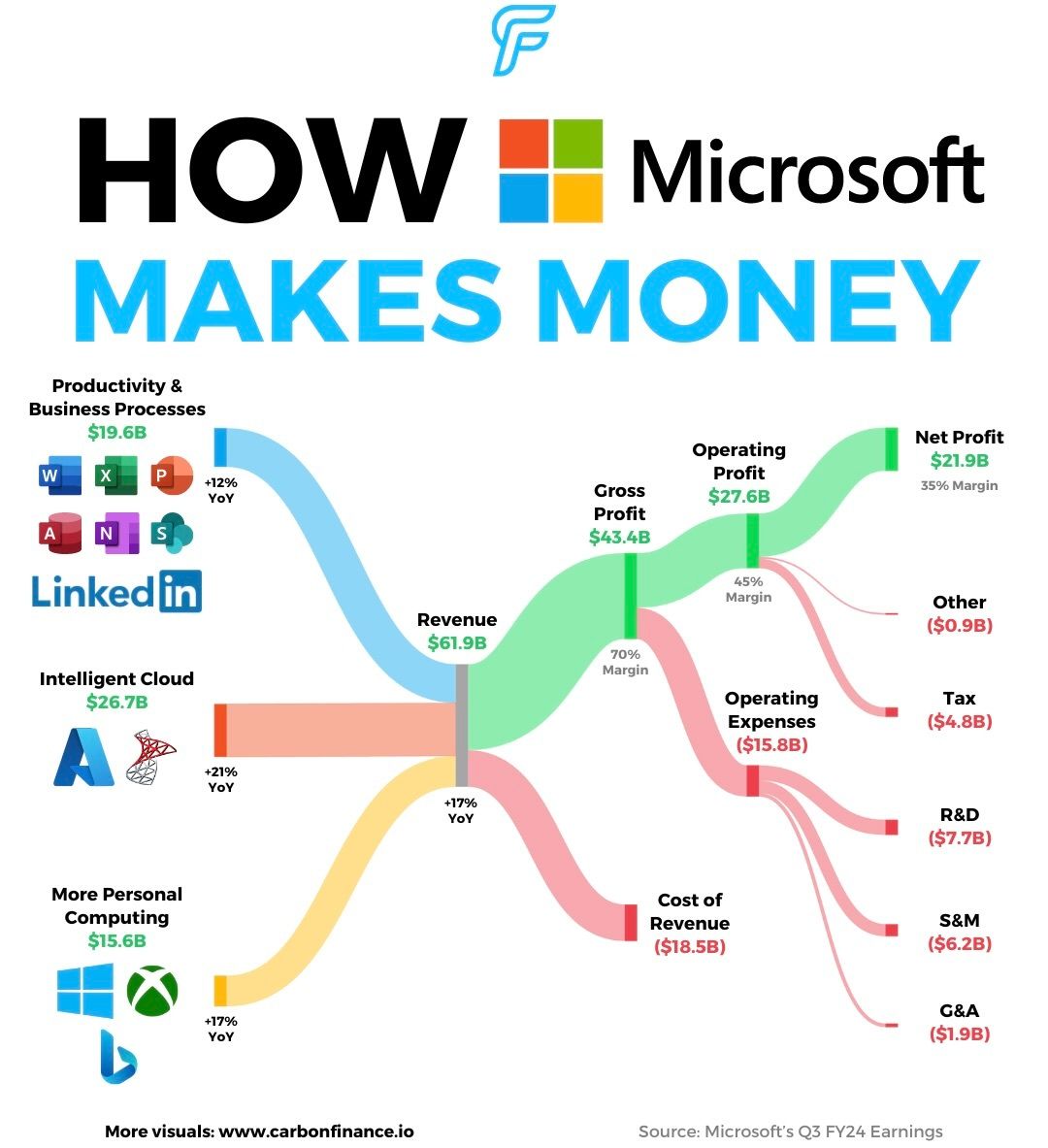

Love this infographic?

Our friends at Carbon Finance sends out a weekly newsletter with simple, data-driven visuals that cover the most important headlines in investing.

The best part is it’s completely free and only takes 5 minutes to read.

It’s one of my favorite reads! Click the button below to automatically subscribe

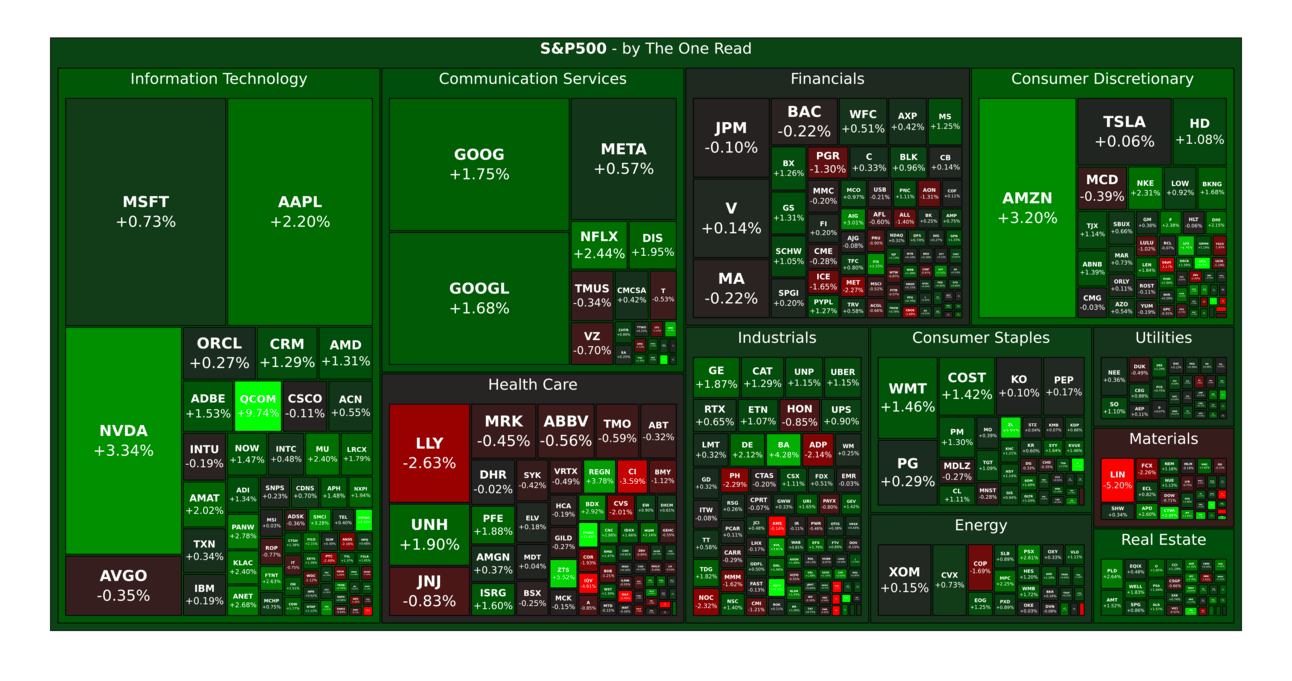

S&P 500 Heatmap 🔥

Recap Around the Street 🧠

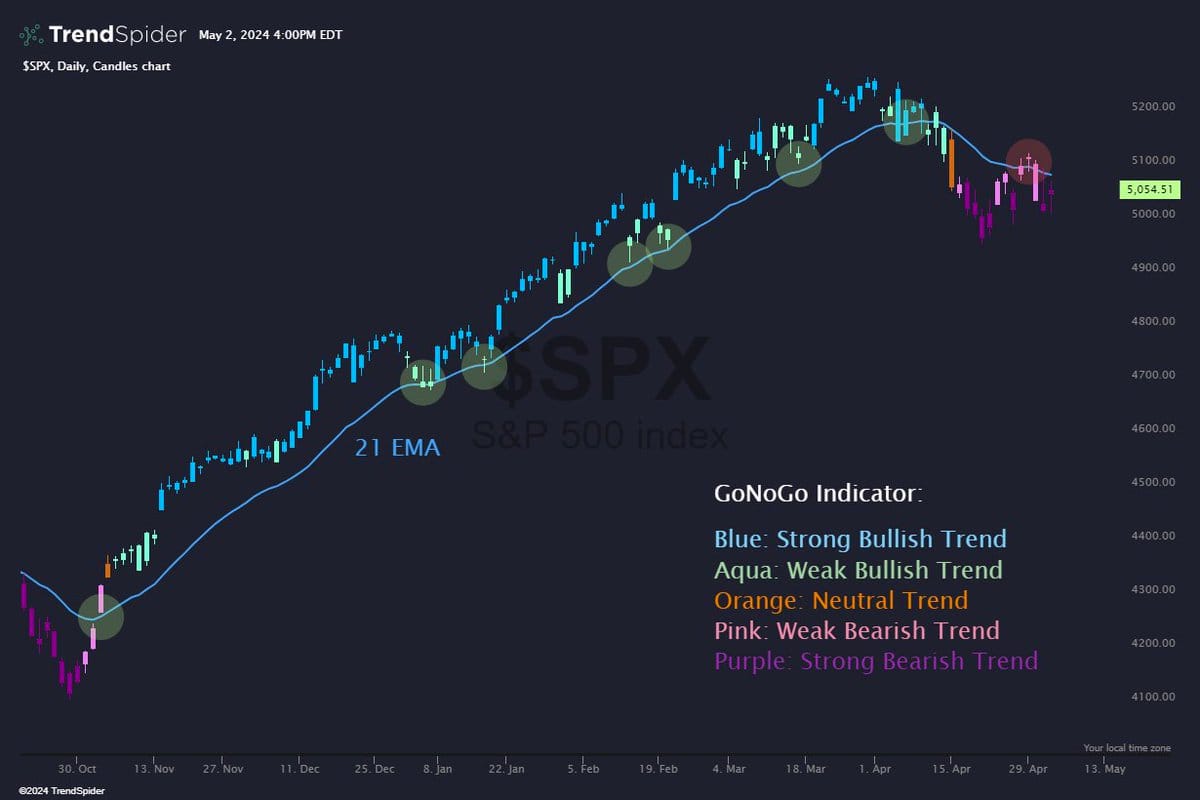

The 21-period EMA has been the key moving average to follow since the October 2023 low. Once price closed decisively below it, the GoNoGo indicator signaled a clear trend change and its acted as overhead resistance ever since. (Contributed by Jason Krutzky of Trendspider ). For charting tools and insights visit their site.

Source: Trendspider

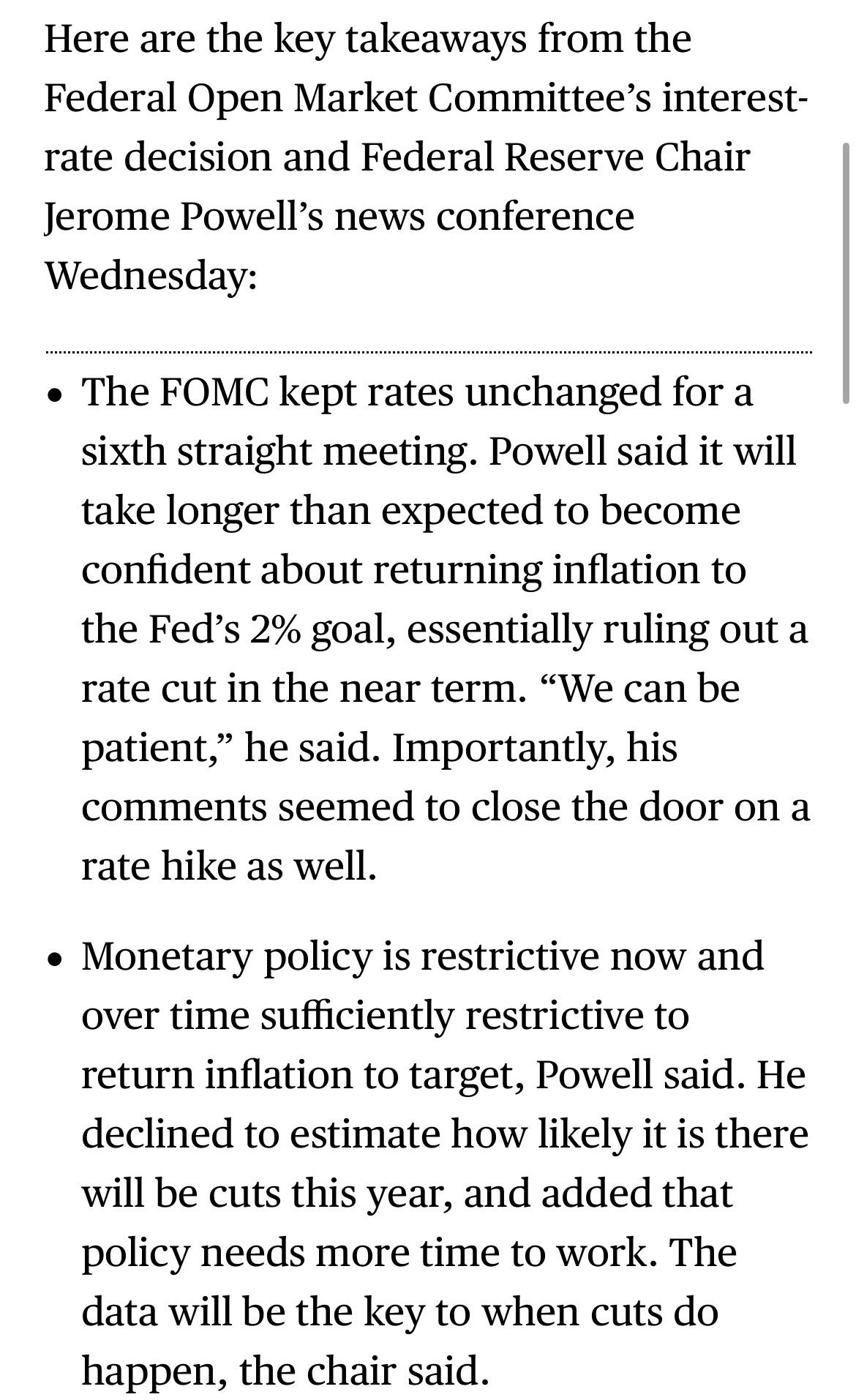

Key takeaways from the US Fed FOMC meeting yesterday:

Source: Bloomberg

Source: Bloomberg

Market Preview 🎞️

Friday, May 3rd: Non-farm payrolls data; Unemployment rate

Enjoy reading?👇

That’s all for this week, folks! We’ll be back around the same time Tuesday with a curated list of important news, economic data and market highlights.

🔔 Be the first to know. Ensure you never do more than one read if you:

Move our emails (especially your subscriber introduction) to your primary inbox (Quick instructions).

👋 Say hi. Responding to our emails (if any) lets your email provider know to not block us from your main inbox.